On Today’s Bad GDP Number, Please Remember: Imports Aren’t a “Drag on Growth”

Media reports often blame U.S. imports and an expanding U.S. trade deficit for disappointing quarterly gross domestic product (GDP) results. Weak GDP readings might signal underlying problems for the U.S. economy, but the growing demand for imported goods for U.S. households and companies isn’t one of them.

In its preliminary snapshot of first‐quarter GDP growth in 2022, the U.S. Bureau of Economic Analysis pointed to a drawdown of inventories, a slowdown in exports, and decreased government spending as factors behind the drop in GDP. But the agency also noted that imports “are a subtraction in the calculation of GDP.”

News reports this morning have unfortunately gone even further, assuming that a rising trade deficit in the first quarter actually “pushed growth lower” or calling it a “drag on growth.” Opponents of free trade, such as President Trump’s former advisor Peter Navarro, routinely say the same, decrying the trade deficit “drag” and proposing to eliminate it (via protectionism and industrial policy) to boost U.S. output.

Such claims, however, reflect a basic misunderstanding of the GDP calculation and the broader relationship between imports and U.S. economic growth. Indeed, if you dig a bit deeper into the BEA report, and into recent U.S. economic performance, the supposed negative connection between imports and GDP growth falls apart.

First, the basics. When the BEA calls imports “a subtraction from the calculation of GDP,” it’s describing an accounting technique, not a real economic phenomenon. Imports, by definition, are not part of gross domestic product. The BEA, however, is not able to discern the import content of goods and services produced in the United States. Instead, it adds up as best it can total domestic consumption in a given period, and then it subtracts imports, assuming that what is left must have been produced domestically. If the BEA did not subtract imports from its calculation of GDP, it would be wrongly attributing goods made abroad to those made at home.

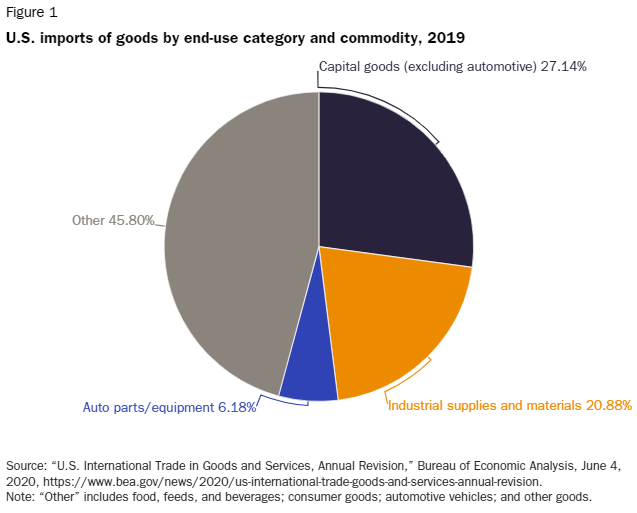

The other wrong assumption made about imports is that they are a one‐to‐one substitute for domestic production. In fact, imports often complement domestic production. As Lincicome and Alfredo Obregon just noted in a new paper, more than half of U.S. imports are intermediate goods, raw materials, and capital equipment, which U.S. companies use to make their final products and remain globally competitive.

Even imported consumer goods can complement domestic output by reducing retail prices and thus freeing consumer dollars for spending on domestic goods and services. U.S. companies tasked with moving or selling imported items – in wholesale trade, retail trade, and transportation and warehousing – also generate trillions of dollars of additional U.S. economic output. And, of course, dollars spent on imports quickly return to the United States, either to invest in U.S. assets or to buy U.S. exports, both of which contribute to GDP growth. As Lincicome and Obregon note, “[t]otal foreign direct investment assets (‘stocks’) in the U.S. manufacturing sector alone hit $1.8 trillion in 2019…, and majority‐owned affiliates of all foreign multinational companies contributed $1.1 trillion… to gross domestic product that same year.”

If imports were a drag on growth, we should expect to see some connection in the real world between the change in imports and economic growth. If anything, the correlation seems to run in the opposite direction from what the media imply. In recent decades, stronger economic growth has tended to correlate with a rising U.S. trade deficit (as Griswold found in this Cato study.) In the first three years of the Trump administration (2017–19), as GDP growth reached a respectable annual average of 2.5 percent and a total of 6 million net new jobs were added, the overall goods deficit increased by $115 billion, or 15.7 percent. In 2021, the first year of the Biden administration, the U.S. economy expanded 5.6 percent as it shook of the Covid shutdown while the trade deficit grew 18.4 percent from the year before.

Finally, the “trade deficit as a drag on growth” narrative falls even under its own Keynesian logic. The same news stories that repeat the mantra that imports dampen growth routinely note that what drives the rise in imports is rising domestic demand. For example, Axios reported this morning, “Trade subtracted 3.2 percentage points from overall GDP growth, as exports fell sharply and imports soared. This reflects a U.S. economy with significantly stronger domestic demand than the rest of the world” (emphasis ours).

The U.S. economy faces headwinds, as this morning’s GDP report and other economic data confirm, but rising imports – driven by strong domestic demand – aren’t one of the problems. We don’t expect Navarro and company to get this, but hopefully more media outlets will.

Read the Cato-at-Liberty blog post here.