Biden Hikes Corporate Tax Expenditures 92%

Politicians often say one thing but do another. President Biden rails against tax breaks for big corporations, and the White House boasts that Biden “has fought to build a fairer tax system that … asks big corporations and the wealthy to pay their fair share; and requires all Americans to play by the same rules.”

But Biden has signed into law three bills with vast subsidies and narrow tax breaks for big corporations. These were not across‐the‐board tax cuts that simplified the tax code, but rather a mess of complex loopholes with special rules for favored industries.

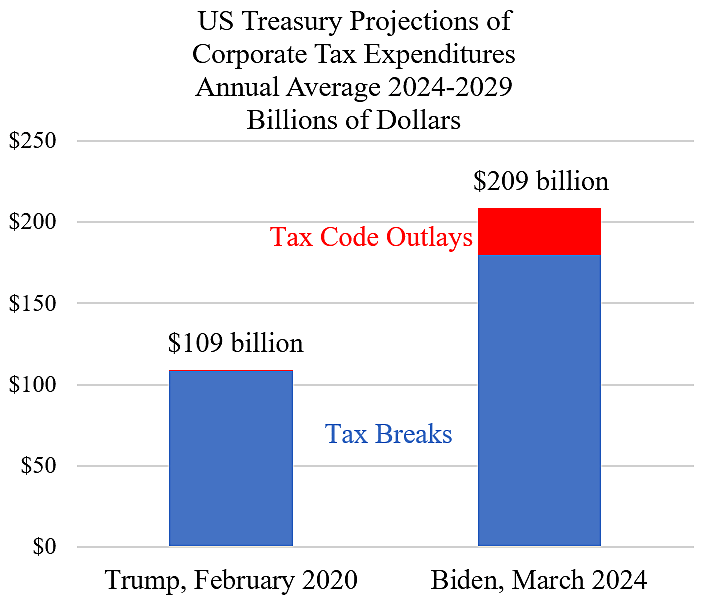

How large are Biden’s special‐interest corporate breaks? The US Treasury issues annual estimates of “tax expenditures” or loopholes showing the size of each tax break. This official tally of tax expenditures is biased but can provide a rough measure of the change in narrow breaks over time. Let’s compare the corporate breaks under Presidents Biden and Trump.

The Treasury projects tax expenditures for 10 years, so I choose six years of overlap between the Trump and Biden figures, fiscal years 2024 to 2029. The chart shows the annual average total corporate tax expenditures as measured today, and as measured four years ago in the last year of Trump’s tenure. Since then, Biden has signed into law many new and expanded breaks, particularly in the Inflation Reduction Act with its massive subsidies for energy companies.

President Biden has increased annual average corporate tax expenditures 92 percent from $109 billion to $209 billion. Thus Biden has almost doubled narrow corporate breaks, despite all his rhetoric about fairness, fair shares, and people playing by the same rules.

The chart includes both tax cuts and tax provisions that provide outlays to companies. Tax‐code outlays have increased from $0.3 billion a year projected under Trump to $29 billion a year under Biden. These are the red boxes at the top of the two bars.

Biden administration policies on corporate taxes are the opposite of fairness. He has signed into law complex and anti‐growth increases in corporate taxes, and his current budget proposes to raise the overall corporate tax rate. Yet at the same time, Biden has signed into law an explosion of corporate welfare, including narrow tax breaks and spending subsidies in the tax code.

Rather than pursuing low and equal tax rates for all businesses, Biden’s misguided approach is to impose punitive treatment on most businesses while handing out subsidies for the select few.

Data Notes

US Treasury projections of tax expenditures under Trump (FY2021) and Biden (FY2025) are available here. Summing the expenditures does not account for interactions between the provisions, so these totals are only a rough gauge of the overall size of the breaks.

The Treasury does not split the outlay part of tax expenditures between corporate and noncorporate, so I’ve estimated the corporate outlays using the tax cut shares of each provision.

US Treasury estimates of tax expenditures are biased in numerous ways, as I discuss here.

Adam Michel discusses Biden’s energy tax subsidies here.

Read the Cato-at-Liberty blog post here.